Press Release

Date: 10th April, 2018

Executive Summary

This report, prepared by Association for Democratic Reforms (ADR) focuses on Income and Expenditure of Bharatiya Janata Party (BJP) and Indian National Congress (INC), during the Financial Year 2016-17, as submitted by the parties to the Election Commission of India (ECI).

This report should be read in conjunction with the analysis of income and expenditure for FY 2016-17 declared by the other National Parties (less BJP and INC) which was released by ADR on 7th Feb, 2018. The report can be accessed from here.

Submission of audited reports by the National Parties

- The due date for submission of annual audited accounts for the parties was 30th Oct,’17.

- BJP submitted its audited report on 8th Feb, 2018 (99 days delayed).

- INC submitted its audited report on 19th March, 2018 (138 days delayed).

- 7 National Parties (BJP, INC, BSP, NCP, CPM, CPI and AITC) have declared a total income of Rs. 1,559.17 cr, collected from all over India.

- The 7 National Parties declared a total expenditure of Rs 1,228.26 cr.

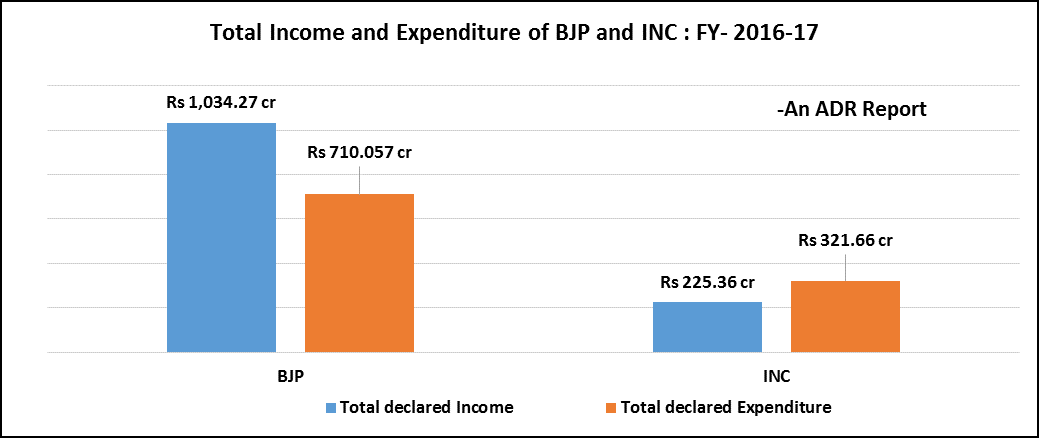

- BJP declared the maximum expenditure of Rs 710.057 cr during FY-2016-17 while INC incurred a total expenditure of Rs 321.66 cr(Rs 96.30 cr more than its total income).

Total Income and Expenditure of BJP and INC for - FY-2016-2017

- 7 National Parties (BJP, INC, BSP, NCP, CPM, CPI and AITC) have declared a total income of Rs. 1,559.17 cr, collected from all over India.

- The 7 National Parties declared a total expenditure of Rs 1,228.26 cr.

- BJP declared the maximum expenditure of Rs 710.057 cr during FY-2016-17 while INC incurred a total expenditure of Rs 321.66 cr (Rs 96.30 cr more than its total income).

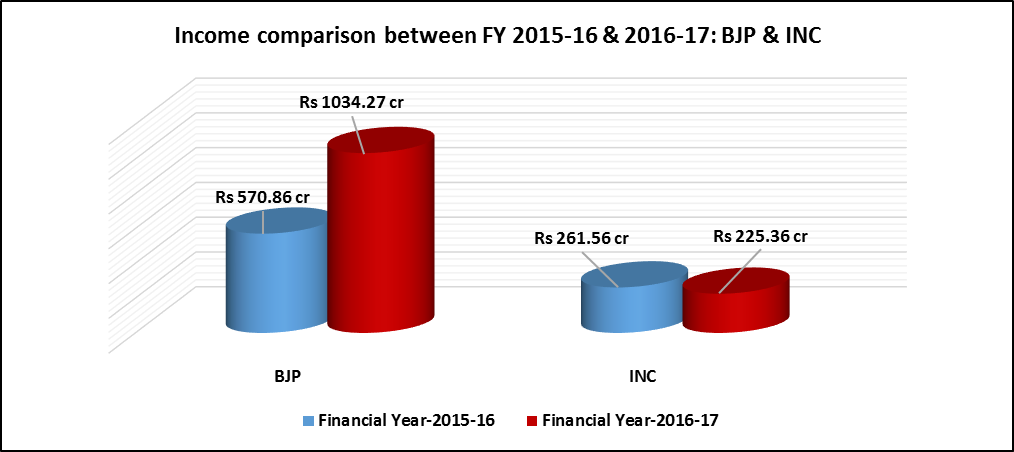

Comparison of total income of BJP & INC between FY 2015-16 and 2016-17

Between FY 2015-16 and 2016-17, the income of BJP increased by 81.18% (Rs 463.41 cr) from Rs 570.86 cr during FY 2015-16 to Rs 1,034.27 cr during FY 2016-17 while the income of INC decreased by 14% (Rs 36.20 cr) from Rs 261.56 cr during FY 2015-16 to Rs 225.36 cr during FY 2016-17.

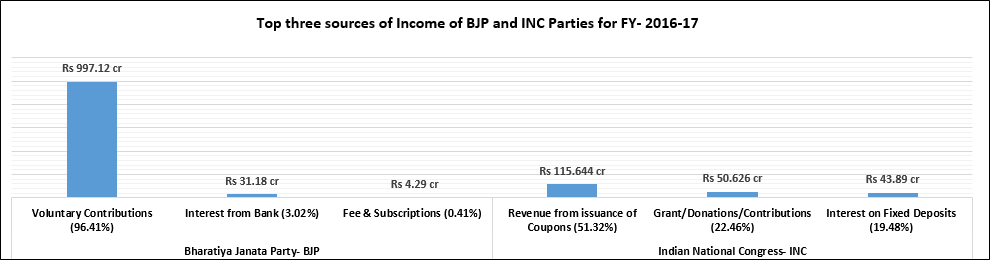

Top 3 sources of income of BJP and INC for FY-2016-2017

• BJP and INC have declared donations/contributions as one of their 3 main sources of income. BJP- Rs 997.12 cr and INC- Rs 50.626 cr.

• Grant/ donations/ contributions of Rs 997.12 cr declared by BJP forms 96.41% of the total income of the party during FY 2016-17. Declaration of Rs 115.644 cr under Revenue from issuance of Coupons by INC forms the top most income of the party, contributing 51.32% of the total income of the party during FY 2016-17.

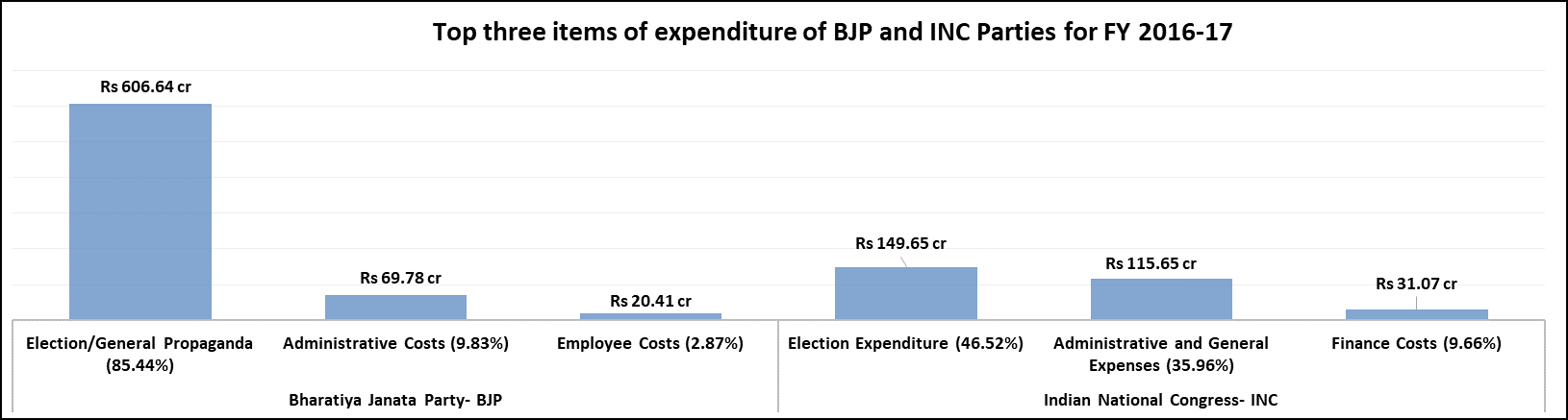

Top 3 items of expenditure of BJP and INC Parties for FY 2016-2017

● The maximum expenditure for BJP during FY 2016-17 was towards Election/ General Propaganda which amounted to Rs 606.64 cr followed by expenses towards Administrative Cost, Rs 69.78 cr.

● INC spent the maximum of Rs 149.65 cr on Election Expenditure followed by expenditure of Rs 115.65 cr on Administrative and General Expenses.

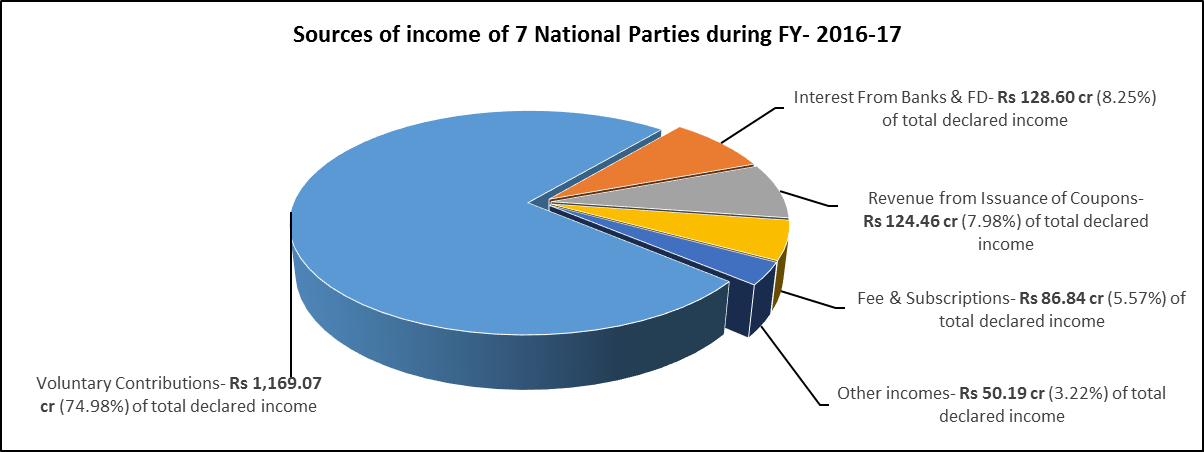

All sources of income declared by National Parties: FY 2016-17

·

7 National parties have collected maximum 74.98% (Rs 1,169.07 cr) income from Voluntary contributions for FY- 2016-17.

·

During FY- 2016-17, National Parties have received Rs 128.60 cr income from Interest from Banks & FD.

·

7.98% or Rs 124.46 cr was income generated through Revenue from Issuance of coupons by National parties during FY- 2016-17.

Observations and Recommendations of ADR

·

4 out of 7 National Parties (BJP, INC, NCP and CPI) have consistently delayed submitting their audit reports for the past five years. The top major parties, BJP and INC, have delayed submitting their audit reports by an average of almost 6 months.

·

It is observed that the 7 National Parties’ total income has increased by 51%, in other words by Rs 525.99 cr. The total income of the 7 National Parties increasing from Rs 1,033.18 cr during FY- 2015-16 to Rs 1,559.17 cr during FY- 2016-17.

·

7 National parties have collected maximum 74.98% (Rs 1,169.07 cr) income from voluntary contributions for FY- 2016-17. In contrast, the parties had have received 60% (Rs 616.05 cr) of their income from voluntary contributions during FY- 2015-16.

- · The Supreme Court gave a judgment on September 13, 2013 declaring that no part of a candidate’s affidavit should be left blank. Along the same lines, we recommend that the Election Commission India impose rules that no part of the Form 24A submitted by political parties providing details of donations above Rs 20,000 should be left blank.

- · Full details of all donors should be made available for public scrutiny under the RTI. Some countries where this is done include Bhutan, Nepal, Germany, France, Italy, Brazil, Bulgaria, the US and Japan. In none of these countries is it possible for 75% of the source of funds to be unknown.

- · According to the Finance Bill, 2017, Section 13A of the IT Act was amended to state that tax exemption will be given to registered political parties “Provided also that such political party furnishes a return of income for the previous year in accordance with the provisions of sub-section (4B) of section 139 on or before the due date under that section.” Thus, any party which does not submit its IT returns on or before the due date, their income should not be tax-exempted and defaulting parties should be derecognized.

- · Those parties not following the ICAI guidelines for auditing of reports should be scrutinized by the IT department.

- · The National political parties must provide all information on their finances under the Right to Information Act. This will only strengthen political parties, elections and democracy.

FOR Scanned Newsclippings>>CLICK HERE

FOR Scanned Regional Newsclippings>>CLICK HERE