Press Release

Date: 7th February, 2018

Analysis of Income & Expenditure of National Political Parties for FY- 2016-2017

This report analyses the details provided by the National Parties in their audit report, submitted to the Election Commission of India (ECI) for the FY 2016-17.

For details of top 3 sources of income to the party and top items of expenditure of the parties, please refer to the detailed reports in English and Hindi attached herewith.

Executive Summary

- The due date for submission of annual audited accounts for the parties was 30th Oct,’17.

- BSP, CPM and AITC submitted their audit reports on time while CPI submitted its audit report 22 days after the due date for submission.

- As on 7th February, 2018, BJP and INC have not yet submitted their audited reports to the ECI, more than three months after the due date for submission.

- BJP and INC have consistently defaulted in submitting copies of their audit reports to the ECI within the specified time limit.

|

Financial Year |

Delay in submission of audit reports to the ECI |

|

|

BJP |

INC |

|

|

FY 2014-15 |

133 days |

153 days |

|

FY 2015-16 |

209 days |

252 days |

|

FY 2016-17 |

99 days, (As on 07-02-2018) |

99 days, (As on 07-02-2018) |

Total Income and Expenditure of National Political Parties for - FY-2016-2017

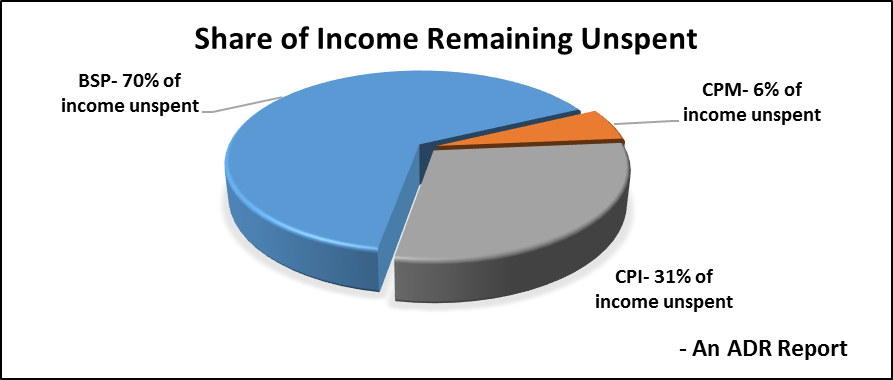

- BSP declared a total income of Rs 173.58 cr during FY- 2016-17, but spent only 30% (Rs 51.83 cr) of the total income.

- AITC declared a total income of Rs 6.39 cr during FY- 2016-17, but spent an excess of Rs 17.87 cr (280%) over total income.

- NCP also incurred an excess expenditure of Rs 7.732 cr over its total income of Rs 17.235 cr, during FY 2016-17.

Graph: Share of income remaining unspent, as declared by National Parties in their audit reports for FY 2016-17 (All over India)

Total Income of National Parties FY 2016-2017

- 5 out of 7 National Parties (BSP, NCP, CPM, CPI and AITC) have declared a total income of Rs. 299.54 cr, collected from all over India.

- BSP has shown the highest income amongst the National Parties with a total income of Rs 173.58 cr during FY 2016-17. This forms 57.95% of the total income National Parties, together during FY 2016-17.

Graph: Total income declared by National Parties in their ITRs for FY 2015-16 (All over India)

Comparison of total income of National Parties between FY 2015-16 and 2016-17

- The income of BJP during FY 2015-16 was highest among all the National Parties. The party had declared a total income of Rs 570.86 cr but is yet to submit its copy of Income Tax returns for FY 2016-17 to the Election Commission of India.

- Between FY 2015-16 and 2016-17, the income of BSP increased by 266.32% (Rs 126.195 cr) from Rs 47.385 cr during FY 2015-16 to Rs 173.58 cr during FY 2016-17 while the income of NCP increased by 88.63% (Rs 8.098 cr) from Rs 9.137 cr during FY 2015-16 to Rs 17.235 cr during FY 2016-17.

Graph: Total income of National Parties for Financial Years: 2015-16 and 2016-17

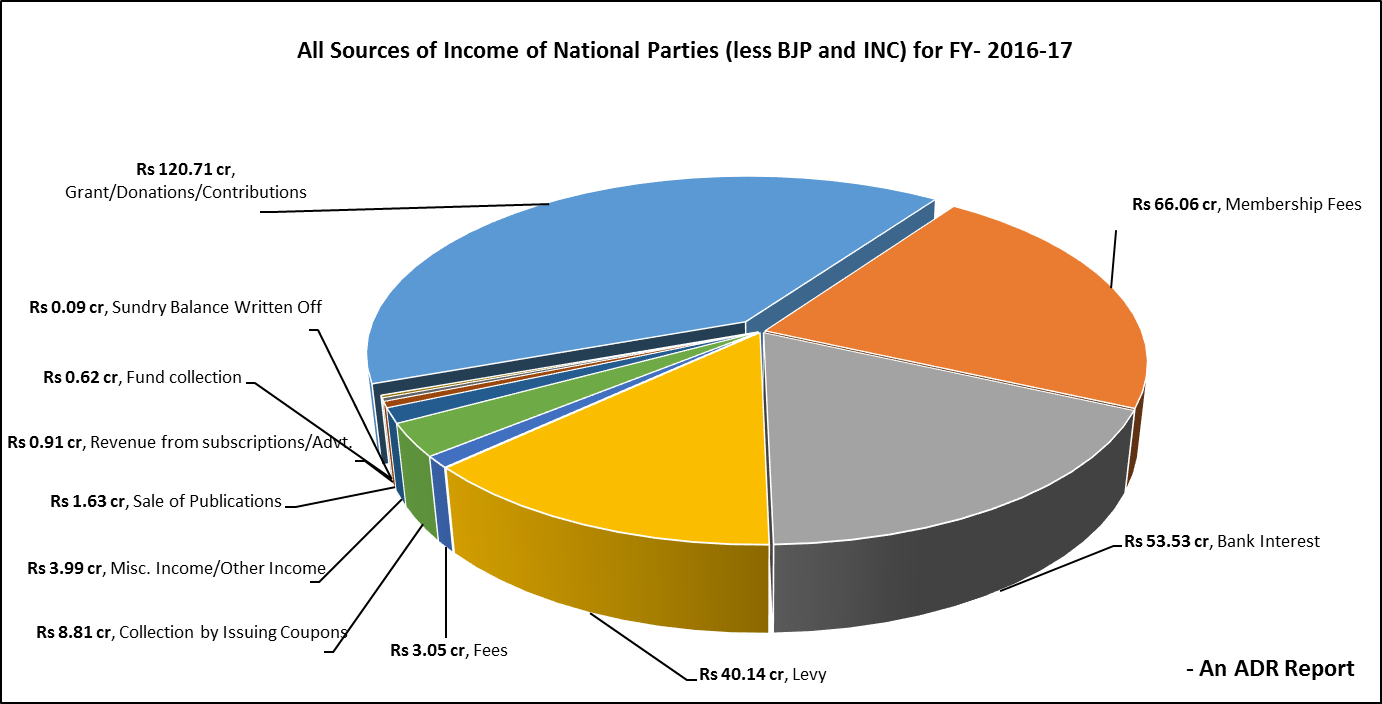

Sources of income of National Parties for FY-2016-2017

- National Parties have declared donations/contributions as one of their 3 main sources of income. BSP- Rs 75.26 cr, CPM- Rs 36.727 cr, NCP – Rs 6.62 cr and AITC- Rs 2.17 cr.

- Grant/ donations/ contributions of Rs 120.71 cr declared by the five National Parties forms 40.30% of the total income of the parties during FY 2016-17. Declaration of Rs 66.06 cr under Membership Fees by the parties forms 22% of the total income of the parties, while Bank Interest constitutes 17.87% of the total income of the parties during FY 2016-17.

Recommendations of ADR

- The Supreme Court gave a judgment on September 13, 2013 declaring that no part of a candidate’s affidavit should be left blank. Along the same lines, we recommend that the Election Commission India impose rules that no part of the Form 24A submitted by political parties providing details of donations above Rs 20,000 should be left blank.

- Full details of all donors should be made available for public scrutiny under the RTI. Some countries where this is done include Bhutan, Nepal, Germany, France, Italy, Brazil, Bulgaria, the US and Japan. In none of these countries is it possible for 75% of the source of funds to be unknown.

- According to the Finance Bill, 2017, Section 13A of the IT Act was amended to state that tax exemption will be given to registered political parties “Provided also that such political party furnishes a return of income for the previous year in accordance with the provisions of sub-section (4B) of section 139 on or before the due date under that section.” Thus, any party which does not submit its IT returns on or before the due date, their income should not be tax-exempted and defaulting parties should be derecognized.

- Those parties not following the ICAI guidelines for auditing of reports should be scrutinized by the IT department.

- The National political parties must provide all information on their finances under the Right to Information Act. This will only strengthen political parties, elections and democracy.

Contact details

|

Media and Journalist Helpline +91 80103 94248 Email: [email protected] |

Maj. Gen Anil Verma (Retd.) Head – ADR & NEW +91 11 4165 4200 +91 88264 79910 |

Prof Jagdeep Chhokar IIM Ahmedabad (Retd.) Founder Member– ADR & NEW +91 99996 20944 |

Prof Trilochan Sastry IIM Bangalore Founder Member– ADR & NEW +91 94483 53285 |

FOR FULL REPORT: CLICK HERE